The United States has recently seen unprecedented declines in cancer incidence and death. As of 2019, there were over 16 million cancer survivors. Surviving prolonged cancer treatment in the US, however, comes with the burden of financial hardship, a cost that continues to increase.

Experiencing financial hardship while undergoing cancer treatment has been linked to worse health outcomes. Extreme financial struggle and medical bankruptcy is associated with an increased mortality rate for cancer patients.

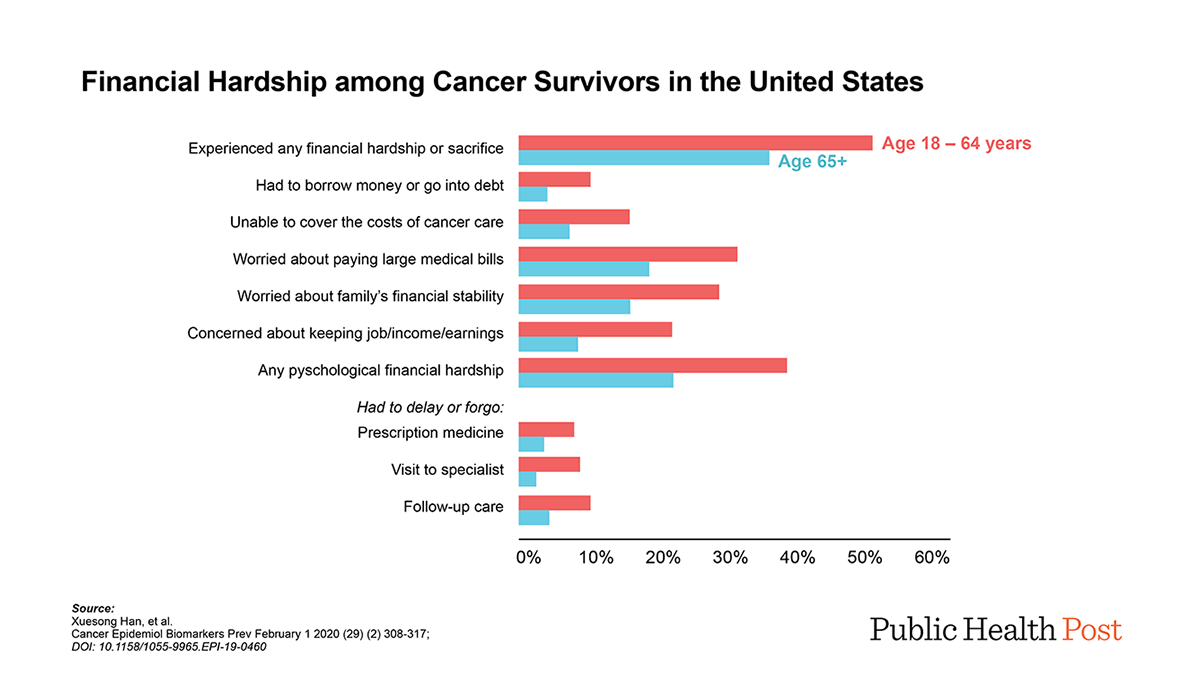

To better understand the extent of hardship experienced by cancer patients, Xuesong Han and colleagues from Emory University and the American Cancer Society surveyed over 900 survivors about their financial experiences related to treatment costs. As seen in the diagram, they found that financial hardship was common among survivors and that the two age groups experienced hardship at different rates.

Fifty-four percent of survivors under the age of 65 experienced financial struggles such as trouble paying medical bills, needing to borrow money, going into debt, or even filing bankruptcy. Around 30% of younger survivors were unable to adhere to cancer treatment plans because of the cost. The majority of younger survivors receive coverage through employer-sponsored health insurance unlike survivors over the age of 65, a majority of whom are covered by Medicare. This is problematic for patients undergoing treatment plans that get in the way of work. Almost one third of younger patients experienced an extended change or loss of employment while undergoing treatment.

In comparison, 38% of those aged 65 and older experienced financial hardship. But most only experienced minor sacrifices, with only four percent needing to borrow money or go into debt.

The higher prevalence of financial struggle among younger cancer survivors provides additional evidence that health insurance protects against hardship. Thanks to the Affordable Care Act, millions more in the US have health insurance, but the quality of that insurance is worsening due to the Trump administration’s deliberate actions to dismantle the ACA. For cancer patients, expanding health insurance that isn’t tied to an employer, as well as offering additional financial guidance and counseling, would lighten the burdens of those who have already braved life-threatening illness.

Databyte via Xuesong Han, Jingxuan Zhao, Zhiyuan Zheng, Janet S. de Moor, Katherine S. Virgo and K. Robin Yabroff. “Medical Financial Hardship Intensity and Financial Sacrifice Associated with Cancer in the United States.” Cancer Epidemiol Biomarkers Prev February 1 2020 (29) (2) 308-317. Visualization by Tasha McAbee.