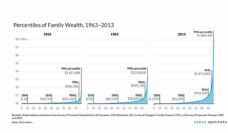

Wealth disparity—the inequality of people based on assets and income—is an age-old problem in the United States. The gap between rich and poor is widening. Three men are wealthier than the bottom 50% of Americans. With inflation, job loss, the pandemic, and lack of housing options, wealth is harder to grow if you don’t have much and easier to keep if you do. Over 37.2 million people in the U.S. are living in poverty. The United States has a wider wealth disparity than any other major developed country.

Dozens of studies have already established a relationship between income and how long people live. The richest 1% live about 15 years longer than the poorest 1% of the population. But is it just income, or are other factors influencing our longevity?

Income is money received for work or from investments. Wealth casts a wider net. It includes all assets—stocks, bonds, retirement and savings accounts, cars, houses, and even boats. These assets are combined with your income, and then debts are deducted. That’s your net wealth.

To understand more about the role wealth has in longevity, Dana Glei, Chioun Lee, and Maxine Weinstein compared wealth quotients to other socioeconomic standards like education attainment, employment type, income, or childhood socioeconomic status to age at death.

The research team looked at data gathered from the Midlife in the United States study, which started in 1995, and collected data on individuals between ages 25 and 74 years. A total of 7,108 participants responded to the study, and the researchers then analyzed deaths from this study population over 18 years.

For older adults, wealth is one of the strongest determinants of living longer.

What Glei, Lee, and Weinstein found overall isn’t surprising: people with more wealth live longer (similar to the income findings). However, when they broke down the study participants into three age categories—early adult (below 40 years), midlife adult (40 years to 65 years), and older adult (65 years and above)—their findings became more complex.

In early adulthood, education attainment is crucial to determining an occupation, which often drives income and early wealth accumulation. The mortality rates were low among early adults throughout the 18-year study compared to those of middle and older adults.

For middle-aged adults, income is a strong determinant of longevity. In mid-adulthood, income and gained wealth influences our ability to purchase a home and gain assets. Middle-aged adults have the highest incomes typically of the three age groups, and their income is a driving force of asset accumulation for older adulthood.

For older adults, wealth is one of the strongest determinants of living longer. Individuals who, at 65, had no assets had a 40% chance of living until 85 years old. However, those who owned at least $300,000 in assets had a 71% chance of living to at least 85 years old.

After retirement, wealth overtakes income in the determination of longevity. Many individuals who acquired more assets and had higher savings before 65 years, from previous income or generational wealth, can live on less income because of this. With other sources of funds, like retirement funds and 401ks, and having assets, like houses and cars, income is less important for livelihood.

So, do people with lower wealth die earlier than those with more wealth? Wealth drives longevity in all age groups, but it becomes more important for living longer the longer we live.

Photo via Getty Images