In recent years, it’s felt like national health insurance legislation is in a constant state of flux. Since the election in November, this feeling has only increased as our new president and Congress promise to do away with the Affordable Care Act while leaving its replacement an open question. As old laws are repealed and new laws are enacted, our lawmakers will be tasked with ensuring that we don’t lose the historic ground we’ve gained in reaching near-universal coverage among children. No single piece of legislation is going to ensure that for all U.S. children; in fact, our recent study from PolicyLab at Children’s Hospital of Philadelphia demonstrated some surprising shifts in the way that working families keep their kids covered.

A Changing Health Insurance Landscape for Families

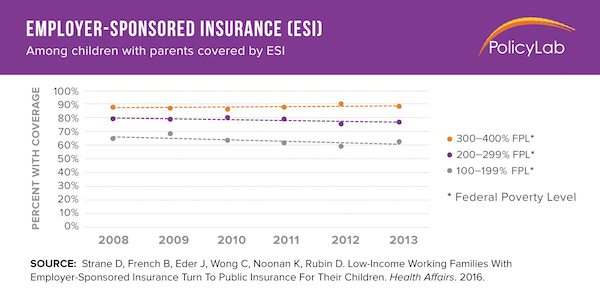

As shifts in national health policy play out in the headlines, it’s been easy to overlook the subtler changes over the last decade that working families have experienced. Employer-based insurance remains the most common source of health insurance coverage for American families, however its steadily increasing costs have made many concerned. Between 2008 and 2015, the amount workers paid for their employer’s family health insurance plan increased substantially, from $3,400 to $4,700 per year. On top of that, large deductibles became more common, meaning that families were paying up to an additional $2,500 out of pocket for their medical expenses. Even for parents that rely on their employer’s family coverage, these costs were making up a bigger and bigger part of their family’s bottom line.

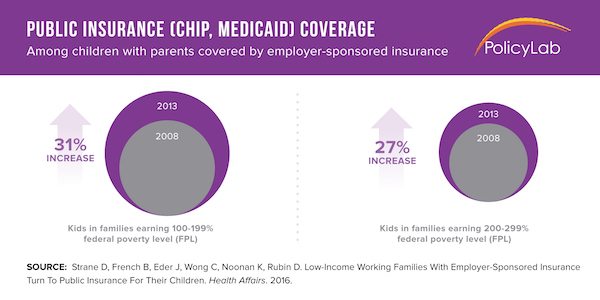

There were, however, alternatives for many families seeking other sources of affordable pediatric insurance coverage: Medicaid and the Children’s Health Insurance Program (CHIP). These public programs offer robust benefits with very low premiums and out-of-pocket costs. Medicaid and CHIP are open to millions of children in working families who qualify based on income. Earlier research from PolicyLab also demonstrated that the parents of children enrolled in Medicaid and CHIP were highly satisfied with their coverage.

We began to wonder whether families were doing the math and switching their children’s health insurance coverage to a public insurance plan if they met income qualifications. We call this “split coverage”: the choice to move a child’s coverage to CHIP or Medicaid, while parents retain coverage through their employer. To see how frequently families chose to “split coverage,” we looked at a sample of low- to moderate-income working American families where the parents had coverage through their employer, and examined what coverage their children had.

It seems as though parents responded to the financial pressure of employer-based insurance by opting to cover their children with public insurance when possible.

Low-Income Working Families Move Towards Public Insurance

Unsurprisingly, we found that the majority of children in these households were covered by their parents’ employer-based health insurance. Over time, however, we saw a 31% increase in the proportion of children in the lowest income households who were covered by public insurance instead of employer-based insurance. By 2013, one-third of working families in this low-income group were “splitting coverage” – that is, relying on CHIP and Medicaid to extend coverage to their children. Among those in the middle-income group, we detected a 27% increase in the proportion of children with public insurance. It seems as though parents responded to the financial pressure of employer-based insurance by opting to cover their children with public insurance when possible. Premiums for individual coverage from an employer are almost always less expensive than family coverage, so working parents likely recognized an opportunity to save money while keeping their kids covered.

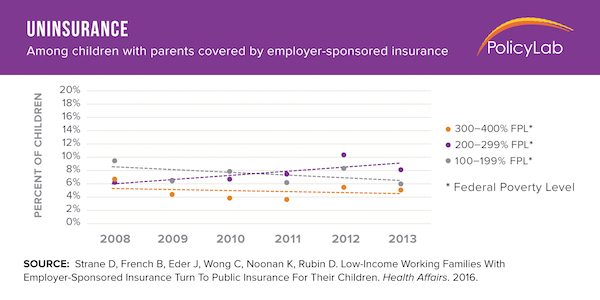

Most concerning though, was an increase in uninsurance found in the middle-income group, despite the consistent national trend towards increasing coverage for children. We believe these families likely felt the substantial financial pressure from employer-based insurance, but couldn’t turn to Medicaid or CHIP in their home state due to income restrictions. These moderate-income households struggled to keep up with rising premiums and out-of-pocket costs from employer-based insurance, and, having nowhere to turn, decided to uninsure their children.

If the ACA is repealed in full, many families currently providing coverage to their children could become ineligible for CHIP or Medicaid.

What’s at Stake Moving Forward

The trends we observed raise concerns as we enter an era of uncertainty around the future of federal health insurance policy. Perhaps most importantly, federal funding for CHIP is set to expire this year, meaning that Congress will need to act to continue a program that 1 in 3 low-income working families use to provide health insurance for their children. If CHIP is not funded, millions of families will face either uninsurance for their children or substantial financial pressure from covering their child with employer-based insurance.

Even if CHIP funding is authorized beyond 2017, the repeal of the Affordable Care Act (ACA), could mean the end of federal law that currently prevents states from lowering the income eligibility limits for Medicaid and CHIP. If the ACA is repealed in full, many families currently providing coverage to their children could become ineligible for CHIP or Medicaid.

Finally, while the ACA provided new options for many, a replacement could improve on the law’s shortcomings. Employer-based insurance is becoming financially unsustainable for many working families; a replacement could ensure that affordable and high-quality private insurance alternatives exist and are fully accessible to working families. Additionally, there is an opportunity to develop plans that work better for children with special healthcare needs.

Ultimately, we already knew that CHIP and Medicaid play vital roles in keeping millions of children covered with high quality health insurance. Our study highlights, however, that public insurance isn’t just keeping kids in working families healthy – it’s likely protecting their families’ bottom line as well.

Feature image: Myles Tan, DSC06183.jpg, used under CC BY-NC-ND 2.0/cropped from original